Let this sound excellent and speak volume into providing solutions to the world trade problems as it was purely orchestrated for. I believe we deserve a detailed elucidation on these aggravating concerns. Solutions to world trade problems won’t suffice if engaging in transnational commerce, promoting social progress, multilateralism, influencing bilateral exposure and enabling bottom-up prosperity isn’t of utmost importance to human existence. The liberty to implement and foster free, fast and unbiased trades on an individual, community, province and nation-state capacity in a seamless approach irrespective of the entities involved will be the first step towards achieving a global, friendly, effective and competitive trading mechanism.

Bearing in mind that the liberating innovation capable of solving and breaking world trade barriers won’t be nothing short of a solution enabling instant & transparent cross-border transactions, fueling being free from oppressive restrictions, imposed by authorities on people’s way of life, behavior and economic prowess within the world marketplace. Ease around building long lasting importing and exporting rails are better achieved by materializing free & fully decentralized trading technologies and tools against protectionism. An archaic and centralized trade policy which has been the order of the day, particularly known for hurting the people it’s intended to protect through slowing down economic growth and increasing inflation on a global scale. An issue evident during post Covid, pre Russia-Ukraine conflict and now.

The traction being displayed in the international trading system has been accumulating over decades reflecting on the actions, policies and body languages of different world unions. Many people are concerned that not everyone is playing by the agreed multilateral rules, high levels of state support and protection remain in key sectors, while new multilateral rule-making is not keeping pace with the business realities of today. These are just but the few problems being faced in today’s economy.

The question before us is, “how do we address and solve these trade barriers created, planned, organized & backed by human errors masquerading as governing rules making the economic revolution repressive ?”

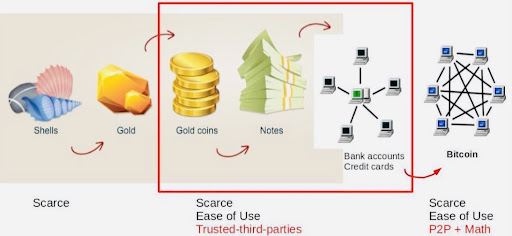

We actively need to reclassify economies and enable integration of a monetary structure free of flaws and human incompetence. There’s no precise best time for positive transmogrification towards globalizing trade and transaction techniques other than now. Zooming into the money evolution. Emphasizing on what money was, what money is, and what money should be is imperative, as it’s the pillar stone upholding every trading activity. The more impeccable money becomes, the more seamless it is to achieve a sustainable economy accompanied with an unerring trading mechanism. Money has taken many structures throughout human history. Gold & cowrie shells served as money in the 14th century but couldn’t meet up with all the characteristics and functions of what money should be. Gold & cowrie shells were scarce but the supply capitalization was not limited while the ease of use feature wasn’t achievable because of the weight of these commodities (gold & cowries shells) in exchange for goods & services in different forms. More gold & shells are definitely being discovered which in turn leads to a level of market saturation

As a way of correcting and solving demerits of these previous commodities known as money. Money was developed and transmogrified into Gold coins, Fiat (notes), bank accounts value & credit cards. Sounds interesting and innovative right ? Feeding your curiosity, this improvement has been able to get rid of some of the previous problems such as “ease of use” but hasn’t been able to address the unlimited supply problem.

The unchecked and consistent production of money(fiat) remains persistent as everyone hangs in the air of trust with third parties called banks, not surprisingly, banks remain subjected to the federal regulations, harnessing the feds and central finance authority the autonomy of printing more money at will. Pathetically, this new form of money serves as a gateway to new trading problems. Some of such is “non-uniformity of money”, “long settlement procedures” & “strict regulations amidst under-collateralization in some jurisdictions”.

These problems remain evident and glaring after the transition of money from gold & cowries shells to fiat, hence the need to cushion the effects of long settlement procedures which has been detrimental to the functionalities of fiat currencies as a seamless medium of exchange across borders quickly became a problem that must be addressed. Some of the approach of addressing that setback despite the acclaimed optimization of money for easy use necessitated the existing monetary body known as “Society for Worldwide Interbank Financial Telecommunication”( SWIFT ). SWIFT addresses a quarter of this problem by facilitating cross-border money transfers in a way that can be classified as quick & structured messaging manner but not exactly swift or instant as to what transactions should be.

That incomplete solution alone indict the process by which payment of goods moves across borders amidst numerous difficulties on trades or transactional measures with more consideration on keeping in line with the centralized economic regulations governing each jurisdiction. Principally, the balant refusal of World Economic Forum (WEF) to enable the globalization of money is masterminded by greed. I accept to disagree it’s due to her experts inability to understand the concept of decentralizing money and democratizing trades. WEF refusal is an economic concept guided with full focus to sustain the Feds’ power drunk addictions–by spicing trade and investments with local currency barriers to slow the flow of products and services between nations.

Some of the consequences of fragmented global economy and central banks autonomy towards consistent & increasing supply of local currencies is indelible and evident in our society with

- Declines in wages and currencies purchasing power in both high- and low-income economies.

- Facing trade-offs between the risk of debt crisis, securing food and fuel amidst countries with developing economies.

- Worst food insecurity over time– especially in the Middle East, North Africa, Sub-Saharan Africa and South Asia.

- Highest inflation rates in history affecting numerous countries not excluding the world trade powers in each continent.

Permit me to ask “Can the root cause of these challenges be tackled in order to revolutionize the contexts of money for fostering global trades without blemish ” ? Quick response, yes it can, let money be money and all trade problems will become obsolete. To solve the trade problems having it root cause attached to all these previous incompetent monies, a monetary innovation called Bitcoin was created to address the flaws of the present day money. A lot of the features it possesses such as limited supply, immutability, transparency, ease of use, censorship resistant, divisibility, fungibility, portability with the juicy and most efficient part of it being it ability to get rid of trust through a decentralized peer to peer trading mechanism back by mathematical computations rather than physical properties like gold or cowries shells.

The characteristics of sound money are durability, portability, divisibility, uniformity, limited supply, and acceptability. Bitcoin possesses all. I noticed “Satoshi knew better” when he created Bitcoin in 2009 as sound money in response to the 2008 financial crisis. Trades should be carried out with the money which the corrupt can’t abuse or influence. Unapologetically, global and local trades should be done with money that has its purchasing power determined by markets, independent of governments and political parties. He (Satoshi Nakamoto) said “the root problem with conventional currency is all the trust required to make it work, the central bank must be trusted not to debase the currency, but the history of currencies is full of breaches of that trust”. Truth be told, the ball is now in every individual’s court to determine and accept this innovation as a solution to the long existing trade problems.

Interviewing Nikolai Tjongarero also known as “Okin” who is a Business mogul & Bitcoin advocate in Namibia. In his response to the question “Despite the central bank of Namibia public declaration of Bitcoin as an acceptable payment option, does the government implement policies to enable it as an official currency for importing and exporting purposes ?” Affirmatively he said “No”.

After a long brainstorming session, I concluded that policy makers in countries that has not yet moved away from import-substitution policies and direct governmental controls should implement structural adjustments rapidly in order to restore their growth, foster quick trades and resume creditworthiness by amending it policy act into conforming with the new normal towards achieving open & free trades by utilizing & adopting global currency as it medium of exchange, unit of account and transfer of value. Bitcoin is the global money for an interconnected world. Utilizing and adopting money that doesn’t care about religion, country, race or creed is the first step towards solving trade bias.

Interestingly, the only method towards the madness of this content is to understand, digest and implement the message rather than tackling the messenger.

Thank you for sharing such a well-structured and informative blog post. I appreciated the way you presented the information and the practical applications you discussed.

The breadth of knowledge compiled on this website is astounding. Every article is a well-crafted masterpiece brimming with insights. I’m grateful to have discovered such a rich educational resource. You’ve gained a lifelong fan!